Case Study

Case Study

Trading Strategy Backtesting

Company

Confidential

Company

Confidential

Company

Confidential

Services

Strategy Simulation, Performance Analysis, Portfolio Modeling

Services

Strategy Simulation, Performance Analysis, Portfolio Modeling

Services

Strategy Simulation, Performance Analysis, Portfolio Modeling

Industry

Financial Markets, Trading

Industry

Financial Markets, Trading

Industry

Financial Markets, Trading

Year

2023

Year

2023

Year

2023

Trading Strategy Backtesting

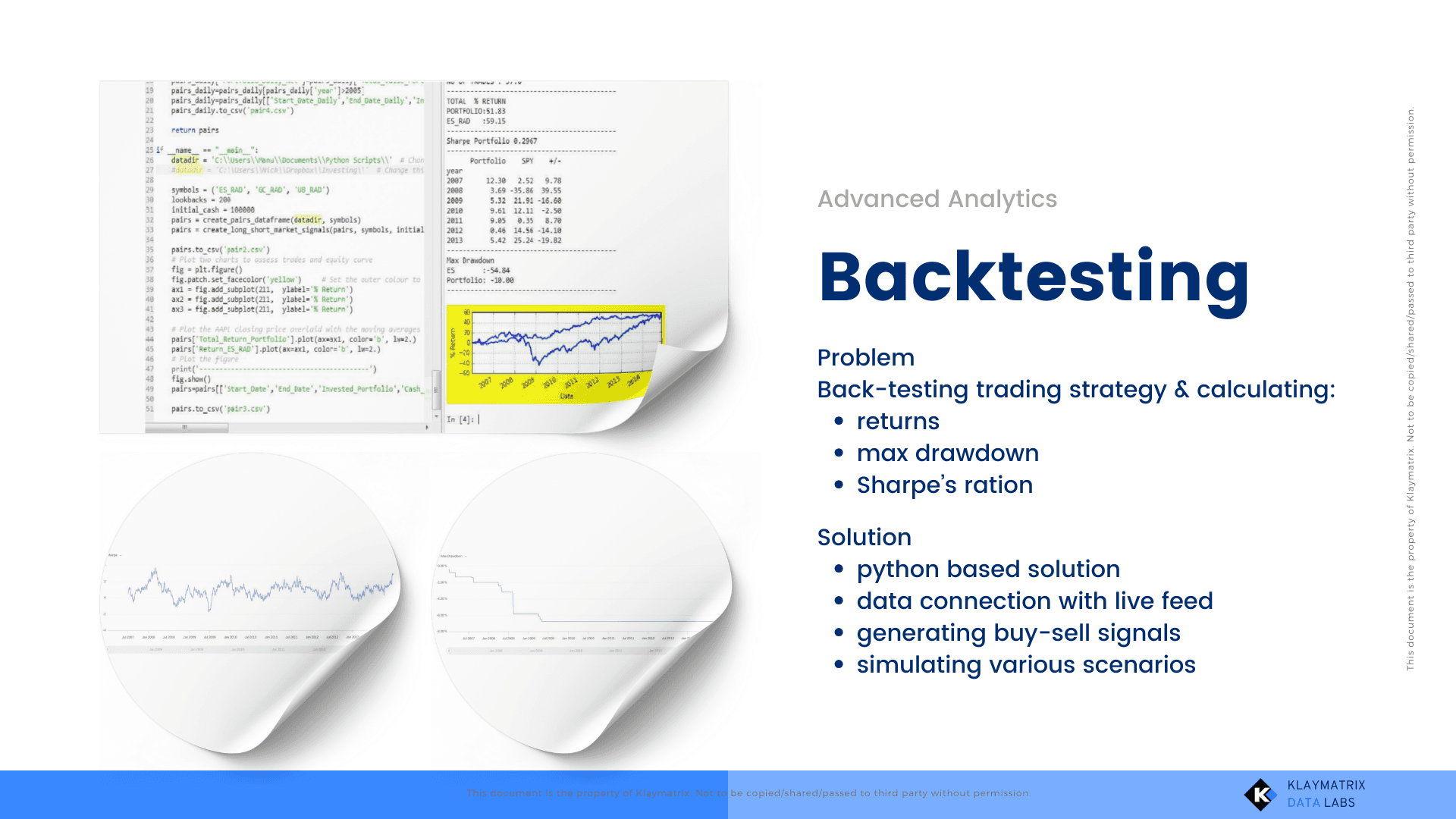

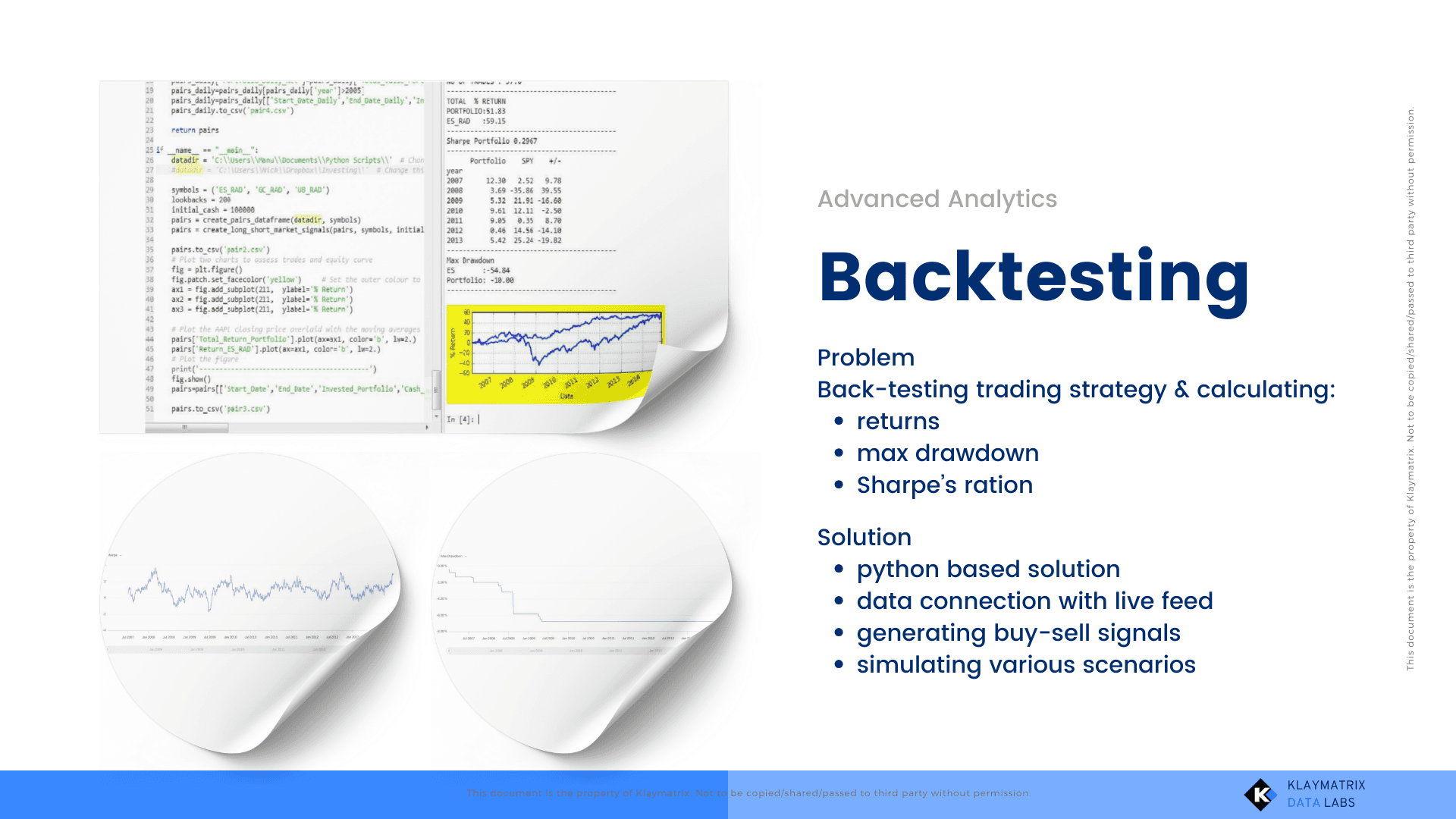

The Challenge

Validate the viability of a custom trading strategy using real-time and historical market data

Incorporate multiple data streams via APIs

Measure key metrics like drawdown, Sharpe ratio, and overall returns

Simulate dynamic portfolio behavior with buy/sell signals

The Challenge

Validate the viability of a custom trading strategy using real-time and historical market data

Incorporate multiple data streams via APIs

Measure key metrics like drawdown, Sharpe ratio, and overall returns

Simulate dynamic portfolio behavior with buy/sell signals

The Challenge

Validate the viability of a custom trading strategy using real-time and historical market data

Incorporate multiple data streams via APIs

Measure key metrics like drawdown, Sharpe ratio, and overall returns

Simulate dynamic portfolio behavior with buy/sell signals

Our Solution

Developed a Python-based backtesting engine tailored to client’s strategy

Integrated market data via APIs to pull relevant time-series data

Programmed logic to simulate buy/sell decisions

Calculated performance metrics: Max Drawdown, Sharpe Ratio, Total Return

Modeled dynamic portfolio allocation to reflect real trading behavior

Used VBA to automate calculations and backend logic

Developed automated reports across separate sheets for daily and weekly review

Enabled collation of data from multiple Excel files

Implementation Highlights

Data fetched using robust API handling with fallback mechanisms

Extensive use of Python and its libraries

Visualized performance and signal points using Matplotlib

Modular code allowing client to adjust parameters or test variations

Demonstrated Expertise

Advanced use of Python for financial analysis and strategy validation

Practical risk analysis using industry-standard metrics (Sharpe ratio, drawdown)

API-driven data handling and dynamic simulation of portfolio behavior

Delivered reusable and customizable script enabling client-led experimentation

Ready to Solve Similar Challenges?

Let’s talk. Reach out to us on support@klaymatrix.com

Our Solution

Developed a Python-based backtesting engine tailored to client’s strategy

Integrated market data via APIs to pull relevant time-series data

Programmed logic to simulate buy/sell decisions

Calculated performance metrics: Max Drawdown, Sharpe Ratio, Total Return

Modeled dynamic portfolio allocation to reflect real trading behavior

Used VBA to automate calculations and backend logic

Developed automated reports across separate sheets for daily and weekly review

Enabled collation of data from multiple Excel files

Implementation Highlights

Data fetched using robust API handling with fallback mechanisms

Extensive use of Python and its libraries

Visualized performance and signal points using Matplotlib

Modular code allowing client to adjust parameters or test variations

Demonstrated Expertise

Advanced use of Python for financial analysis and strategy validation

Practical risk analysis using industry-standard metrics (Sharpe ratio, drawdown)

API-driven data handling and dynamic simulation of portfolio behavior

Delivered reusable and customizable script enabling client-led experimentation

Ready to Solve Similar Challenges?

Let’s talk. Reach out to us on support@klaymatrix.com

Our Solution

Developed a Python-based backtesting engine tailored to client’s strategy

Integrated market data via APIs to pull relevant time-series data

Programmed logic to simulate buy/sell decisions

Calculated performance metrics: Max Drawdown, Sharpe Ratio, Total Return

Modeled dynamic portfolio allocation to reflect real trading behavior

Used VBA to automate calculations and backend logic

Developed automated reports across separate sheets for daily and weekly review

Enabled collation of data from multiple Excel files

Implementation Highlights

Data fetched using robust API handling with fallback mechanisms

Extensive use of Python and its libraries

Visualized performance and signal points using Matplotlib

Modular code allowing client to adjust parameters or test variations

Demonstrated Expertise

Advanced use of Python for financial analysis and strategy validation

Practical risk analysis using industry-standard metrics (Sharpe ratio, drawdown)

API-driven data handling and dynamic simulation of portfolio behavior

Delivered reusable and customizable script enabling client-led experimentation

Ready to Solve Similar Challenges?

Let’s talk. Reach out to us on support@klaymatrix.com

More Cases

More Cases

More Cases

Curious for more? Explore additional case studies and see what’s possible for your business too

Reach out, and we’ll take it from there — with a clear path, structured guidance, and measurable next steps

Phone

+91 9971796261

support@klaymatrix.com

Opening Hours

Mon to Sat: 9.00am - 7.30pm

Sat & Sun: Closed

Services

KLAYMATRIX.

Reach out, and we’ll take it from there — with a clear path, structured guidance, and measurable next steps

Phone

+91 9971796261

support@klaymatrix.com

Opening Hours

Mon to Sat: 9.00am - 7.30pm

Sat & Sun: Closed

Services

Reach out, and we’ll take it from there — with a clear path, structured guidance, and measurable next steps

Phone

+91 9971796261

support@klaymatrix.com

Opening Hours

Mon to Sat: 9.00am - 7.30pm

Sat & Sun: Closed

Services